The Bitcoin Espresso ☕ #6 — Black Friday Market Dip, The Double-Spending Problem

Welcome to this week’s The Bitcoin Espresso! Whether you’re interested in Bitcoin, have just bought your first fractions of Bitcoin, or want to dive deeper into the space — this newsletter is for you. Find out more about the motivation behind this newsletter in the introduction post. Want more news? Follow @thebitcoinespresso on Twitter to stay on top of things between newsletters.

Weekly Summary: Today’s news provides context for the considerable dip that markets took on Black Friday. Furthermore, it discusses Jack Dorsey’s resignation as Twitter CEO and recent happenings at Celsius. The turbulent price action is a suitable occasion to take a step back and consider the long-term perspective of Bitcoin. Therefore, this edition’s focus article covers fundamentals by discussing the core problem that Bitcoin solved.

A quick tip: There’s an explanation of words and abbreviations in the Fundamentals Glossary at the bottom.

📰 Essential News

Black Friday Dip: On Black Friday, Bitcoin followed the market for a considerable dive. This situation demonstrated nicely why The Bitcoin Espresso #4 introduced TradingView as a tool for you. Looking purely at the Bitcoin price with BTCUSD, one would have missed similar price pullbacks for the SPX500USD, DAX, NKY, and others. David Lawant recently tweeted that Bitcoin’s volatility is about seven times higher than the S&P500’s. A 1.7% move for the S&P500 would therefore match a 12% move in Bitcoin’s price. Given this environment, it is reasonable to conclude that Bitcoin moved along with the market’s reaction to a possible new Covid variant. Nevertheless, this could give rise to different speculations for Bitcoin’s short-term price behavior. If this makes you feel unsure, I invite you to jump back to The Bitcoin Espresso #2 and take the time to make a plan and consider your investment time preference if you haven’t yet.

Jack Dorsey stepped down as Twitter CEO: Jack Dorsey is an outspoken Bitcoin proponent, so his announcement of stepping down as CEO started speculations on what that might bring. Dorsey stated that ‟if I were not at Square or Twitter, I would be working on Bitcoin″ at the Bitcoin Conference 2021. He is still the CEO of Stripe, which has recently released a proposal for tbDEX, a decentralized Bitcoin exchange.

Celsius Chief Financial Officer Arrested: Last week, I mentioned the risks of the comparably new crypto borrowing and lending space. Shortly after, news arrived that the Chief Financial officer of Celsius, a cryptocurrency borrowing and lending platform, got arrested. Regardless of this example, it is always advisable to do background research on cryptocurrency platforms before using them.

🎯 Focus: The Core Problem Bitcoin Solved

Discussions surrounding Bitcoin often question what problem it solves and why it is more than magic internet money. To approach an answer, we’ll look at what it took for Bitcoin to become the world’s first digital monetary network.

Electronic cash was a topic of research for years, but one problem stood in the way of realizing that vision — the double-spending problem. Double spending means successfully spending money more than once. Imagine taking a $5 bill and paying with that single bill twice for a total value of $10. That wouldn’t do for sound money.

Especially for digital currencies, double-spending is problematic. In contrast to printed or minted bills and coins, duplicating digital information is relatively easy. Copy and pasting a text document is alright, but copy and pasting money generally isn’t.

A prevailing solution for this problem is to trust a central authority that observes and checks all payments. To quote Satoshi Nakamoto’s Bitcoin whitepaper: ‟The problem with this solution is that the fate of the entire money system depends on the company running the mint [creating the currency], with every transaction having to go through them, just like a bank.″¹

In computing, we describe systems such as these as having a single point of failure. If this part of the system fails, it stops the entire system from working. Having a single point of failure is a profoundly undesirable property for any system that wants to be highly reliable and available, be it business practice, software application, industrial- or financial systems. Satoshi Nakamoto, a pseudonym for an anonymous person or group, invented the solution we know as Bitcoin. Before Bitcoin, there was no way to make direct payments over a communication channel like the internet without a supervising third party acting as a single point of failure.

Let’s consider Satoshi’s description of Bitcoin before we take it one step at a time. Bitcoin is ‟a peer-to-peer network using proof-of-work to record a public history of transactions that quickly becomes computationally impractical for an attacker to change if honest nodes control a majority of CPU power″¹.

Computer networks often work in a client-server architecture, where servers provide functionality or resources to clients that request it. For example, you use a web browser like Google Chrome as a client to access online banking functionality provided by your bank’s web server. You don’t have control over the provided functionality, and if the bank’s web servers are down, the system becomes inaccessible.

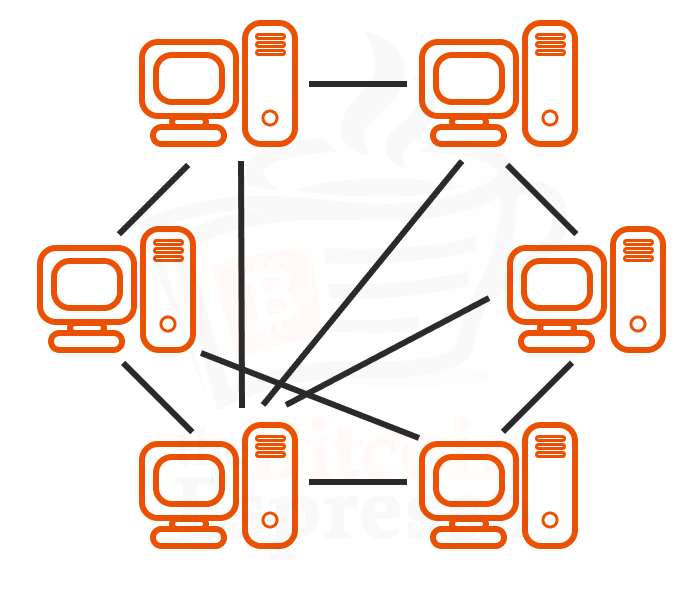

Peer-to-peer networks follow a different architecture. They distribute tasks between equally privileged network participants called peers or nodes. Nodes simultaneously work as both clients and servers to the other nodes on the network. As long as there are nodes to connect to, the system will work as intended.

The nodes in the Bitcoin peer-to-peer network manage an ongoing public history of transactions. This history is called a ledger. It’s a collection of accounts with records of transactions and debit and credit sides, just like in bookkeeping. The digital ledger that the Bitcoin network collectively manages is called the blockchain. You can think of the blockchain as a shared database of Bitcoin transactions. As part of their work, nodes verify the correctness of each transaction and reject invalid ones, such as those trying to pay with already spent Bitcoin. Transactions are only written to the blockchain if the majority of nodes agree that it is valid.

Adding transactions to the blockchain requires computing power for a mechanism called proof-of-work. Proof-of-work ensures that transactions are unchangeable without redoing the work to write them to the network in the first place, in addition to the work required for all transactions that came after them in the blockchain. Therefore, with proof-of-work, the blockchain serves as proof of the transaction history and proof that the largest pool of computing power agreed to it. That is a core concept of Bitcoin. As long as the majority of nodes don’t consistently cooperate to attack the network, Bitcoin works as intended. The whole network with its collective computing power is Bitcoin’s defense mechanism against attacks. There’s no single entity to attack to bring it down.

This combination of a peer-to-peer network, a public digital ledger (the blockchain), and a proof-of-work mechanism allows Bitcoin to avoid a central authority while still solving the double-spending problem. This decentralized approach, avoiding a third party such as a bank, Visa, Mastercard, or PayPal, is why Bitcoin is that revolutionary. Centralized solutions existed before. Thanks to Bitcoin, everyone in the world with a smartphone and internet access can now make monetary transactions without having to rely on or trust any central authority or infrastructure.

Today’s focus spanned topics that could have taken dedicated articles. Nevertheless, I believe that common misconceptions about Bitcoin are due to looking at these concepts in isolation, while Satoshi’s research requires consolidating them. I hope this The Bitcoin Espresso edition has provided you with a new angle on the topic.

¹ Bitcoin: A peer-to-peer electronic cash system. S. Nakamoto. (2009). http://www.bitcoin.org/bitcoin.pdf

Do you think others could enjoy this week’s focus topic? Share it with them!

And if you haven’t yet, sign up for The Bitcoin Espresso now!

Can’t get enough of reading newsletters? Check out The Sample 💌, which sends you newsletter recommendations based on your interest.

💡 Fundamentals Glossary

Blockchain … the digital ledger that the Bitcoin network collectively manages as a shared database of transactions

Crypto … Common abbreviation of the whole cryptocurrency space, which goes beyond digital currencies and also spans across decentralized finance (DeFi), non-fungible tokens (NFTs), and many other innovations.

Ledger … a bookkeeping concept; a collection of accounts with transactions of either debit or credit in separate columns having a closing balance

Peer-to-Peer Network … a computer network architecture with equally privileged network participants that work as both clients and servers to the other nodes in the network

Proof-of-Work … a form of cryptographic proof to ascertain that a specific computational effort has been expended

Do you want me to tackle a particular topic? Or do you want to tell me how The Bitcoin Espresso is doing? Give feedback or comment on this post so I can make this the best newsletter possible.

The Bitcoin Espresso does not constitute financial- or investment- advice, nor is it an offer or invitation to purchase any digital assets. You are solely responsible for your own investment decisions.

The Bitcoin Espresso is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness, or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance, or events that differ from those statements.