The Bitcoin Espresso ☕ #5 — Stablecoins

Hillary Clinton on Bitcoin’s potential & El Salvador announcing Bitcoin City

Welcome to this week’s The Bitcoin Espresso! Whether you’re interested in Bitcoin, have just bought your first fractions of Bitcoin, or want to dive deeper into the space — this newsletter is for you. Find out more about the motivation behind this newsletter in the introduction post. Want more news? Follow @thebitcoinespresso on Twitter to stay on top of things between newsletters.

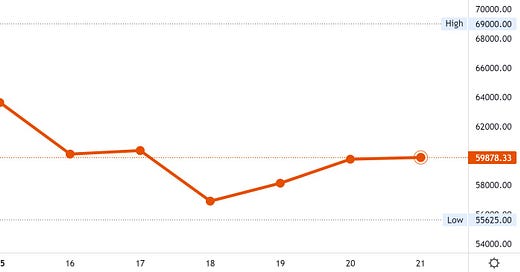

Weekly Summary: Price was thrown around this week with a mix of FOMO and FUD. Hillary Clinton spoke her mind about the potential of Bitcoin, El Salvador announced a Bitcoin City with an advantageous tax structure, and Paypal enabled crypto payments for merchants. I hope recent editions of this newsletter have provided you with the knowledge and tools you need to navigate this emotional phase of the halving cycle. This week, we try something new with a 🛋️ Coffee Chat. This new section answers questions from you. Since I haven’t done extensive research for this part — as I do for the focus parts — this will include more opinions than usual. Let me know what you think!

A quick tip: There’s an explanation of words and abbreviations in the Fundamentals Glossary at the bottom.

📰 Essential News

Hillary Clinton on the Potential of Bitcoin: At a panel for Bloomberg New Economy Forum in Singapore, Hillary Clinton said that Bitcoin has the potential for ‟undermining currencies, for undermining the role of the dollar as the reserve currency, for destabilizing nations″. That was quite a journey from treating Bitcoin as magic internet money to stating that it is such a powerful innovation that it could have destabilizing effects to that degree.

El Salvador announces a Bitcoin City: El Salvador, the first country in the world to make Bitcoin legal tender, plans to build a ‟Bitcoin City″. The city is announced to waive all taxes except for value-added tax (VAT) and get geothermal power from a volcano, which they plan to also use for Bitcoin mining. I’m not even joking.

Paypal enables Paying in Crypto for Checkouts: Paypal now supports Cryptocurrencies for checkouts. You can now use PayPal to buy, sell, hold and pay with cryptocurrencies. It’s always good to see efforts to reduce friction for the use of crypto.

🛋️ Coffee Chat

A Bitcoin Espresso reader recently asked what the best stablecoin is. Let’s start with what stablecoins are and what they can be used for. Stablecoins are cryptocurrencies aiming to maintain a stable value relative to a specified asset (usually, the U.S. dollar). Trading between Bitcoin and a fiat currency like the dollar is a taxable event in most countries. Swapping between cryptocurrencies is often exempt from this. So if you want to profit from trading, it can be favorable to stay between BTC and a stablecoin and choose to switch to a fiat currency only if it is a good time for you from a tax standpoint.

Tether is the largest stablecoin. Nevertheless, its market share is declining since exchanges have introduced stablecoins. For example, Coinbase has introduced USD Coin (USDC) and Binance USD by Binance. So what is the best one? The first thing that comes to my mind is that it should be tradeable on your chosen exchange. Otherwise, you’d have to first find a crypto exchange that offers the trading pair you’re looking for.

Right after that, I’d be mainly worried about the stablecoins collateral backing and their regulatory compliance. After all, you don’t want your safe haven currency to be a significant source of risk. The IMF report I recently shared provides data in chapter 2 on pages 48 and 49. It even has a graph about stablecoin collateral and a section about issues specific to stablecoins. This recent Bloomberg article gives some background on what’s happening behind the scenes and hints at risks we can expect in the short term. These two sources should allow you to identify red flags and choose accordingly.

As for earning interest on stablecoins (or Bitcoin, for that matter), I’m still sitting on my hands. This particular space is promising but currently has an unstable vibe to me. It’s a potential topic of investigation for an eventual bear market, where weaker players will be flushed out to leave us with more trustworthy choices. I’ll apply my due diligence before getting in on this one.

Do you like this week’s edition? Feel free to share it!

And if you haven’t yet, sign up for The Bitcoin Espresso now!

Can’t get enough of reading newsletters? Check out The Sample 💌, which sends you newsletter recommendations based on your interest.

💡 Fundamentals Glossary

Cryptocurrency … A digital currency that uses cryptography to prevent counterfeiting and fraudulent transactions. There are other cryptocurrencies besides Bitcoin.

Fear of missing out (FOMO) … in the Bitcoin context often used with relation to missing out on profits from expected rising prices

Fear, uncertainty, and doubt (FUD) ... in the Bitcoin context commonly understood as misinformation to cause panic selling from investors

Mining (Bitcoin) ... The CPU (processing power) intense activity to process transactions in the Bitcoin network to get rewarded in Bitcoin.

Stablecoin … A cryptocurrency that aims to maintain the value of a specific asset (often the U.S. dollar).

Do you want me to tackle a particular topic? Or do you want to tell me how The Bitcoin Espresso is doing? Give feedback or comment on this post so I can make this the best newsletter possible.

The Bitcoin Espresso does not constitute financial- or investment- advice, nor is it an offer or invitation to purchase any digital assets. You are solely responsible for your own investment decisions.

The Bitcoin Espresso is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness, or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance, or events that differ from those statements.