Welcome to this week’s The Bitcoin Espresso! ☕ Whether you’re interested in Bitcoin, have just bought your first fractions of Bitcoin, or want to dive deeper into the space — this newsletter is for you. Find out more about the motivation behind this newsletter in the introduction post. Want more news? Follow @thebitcoinespresso on Twitter to stay on top of things between newsletters.

Weekly Summary: Bitcoin’s price moved an impressive +40% in October and consolidated last week after the recent all-time high (ATH). That’s a fitting occasion to celebrate the Bitcoin whitepaper anniversary. Nevertheless, there are some unknowns in Bitcoin’s macroeconomic environment to keep an eye on in this week’s news. The focus topic in this edition is having a plan — the best defense I know against FOMO (Fear of Missing Out) and FUD (Fear, Uncertainty & Doubt) to help you stay in control in the likely turbulent upcoming weeks and months.

A quick tip: There’s an explanation of words and abbreviations in the Fundamentals Glossary at the bottom.

📰 Essential News

Bitcoin Whitepaper Anniversary: 13 years ago, on Oct 31st, an anonymous person or group using the pseudonym of Satoshi Nakamoto published the Bitcoin whitepaper. It’s a well-written document of just nine pages. Even if you skim through it, the vital ideas come out clearly. I’m still amazed at how many prominent people discuss Bitcoin without having read this most influential work about it.

FOMC Meeting: The Federal Open Market Committee (FOMC), which determines the course of the US monetary policy, has a highly anticipated meeting today and a press conference tomorrow. The expectation is that they will announce a slowing of asset purchases, a so-called tapering, as the economy has stabilized. Depending on the roadmap’s details, this could have noticeable effects on the markets. Contrary to some beliefs, Bitcoin is affected by macroeconomic changes. Therefore, the FOMC’s decisions could affect Bitcoin’s price as well.

SQUID crashes: Anonymous founders created an altcoin, an alternative cryptocurrency to Bitcoin, inspired by the Netflix show Squid Game. SQUID rose to a price of ~$2860 before the founders cashed out in a scam move and brought the price crashing down to ~$0. The resurgence of so many new coins with dubious propositions — and investors falling for them — surprises me since we were in a similar situation with the “ICO craze” in 2017. Back then, people generously invested in all kinds of hyped-up projects, most of which failed, and I had hoped that the space had matured. While I believe that there are promising altcoin projects, let SQUID serve as a reminder that the IMF report I shared with you last week documents that only 9000 of 16000 listed altcoins still exist.

🎯 Focus: Having a Plan

Last week, we focused on the importance of halving cycles for Bitcoin. But how can this knowledge work in your favor? One advantage is that it allows you to plan how you act in the market cycles ahead of time. Especially when Bitcoin has rapid price movements, things get incredibly emotional.

If the price jumps up, it often comes with a flood of FOMO (Fear of Missing Out). The essence of such information, which can come in many forms such as news or tweets, is that something so incredible happened or will happen that you have to buy more Bitcoin immediately to profit from supposed price increases.

On the other side of the coin is FUD (Fear, Uncertainty, Doubt). If the prices plunge, there is usually information that aims to convince you that something catastrophic happened or will happen. The goal is to make you panic-sell your holdings to protect yourself from alleged possible further losses.

Usually, convictions of both categories are right to a certain degree. By preparing and having a plan, you gain the necessary distance to step back and stay in control. In such times the Fear & Greed Index, which measures the sentiment around Bitcoin, can be helpful to understand if the market reacts too emotionally. Moreover, you can rest assured that I will do my best to write a calm take on critical topics in this newsletter.

A significant preparation step is to understand your time preference. I know people who bought Bitcoin in 2017 at $19k and watched it crash to $3k. Nevertheless, they held their Bitcoin to the current price of $60k. Investors like this have a long time preference. They watch the market from afar and typically sell parts of their investment when prices are high to reaccumulate at lower price levels. They don’t care too much about timing the market since their conviction of Bitcoin is high or their risk low.

A short time preference means wanting to make a profit with Bitcoin fast. Investors with a short time preference typically buy or sell Bitcoin with the intent of trading it quickly at better prices. They might even actively trade during the day to profit from correctly forecasted price movements. Traders with a short time preference can make considerable profits quickly but also carry significant risk. Especially for this time preference, remember to invest only what you can afford to lose.

Between these time preferences are strategies for investors that follow the market but don’t attempt timing it perfectly, such as:

Dollar-Cost Averaging (DCA) ... buying Bitcoin in fixed periods such as weekly or monthly.

Buying the Dip (BTD) ... buying Bitcoin when the price falls.

Trading at opportune moments in the halving cycles.

For any time preference, keep the current tax legislation for Bitcoin in your country in mind since taxes could make some investment strategies unfeasible for you. Buying, selling, or swapping Bitcoin for other cryptocurrencies are considered taxable events in some countries.

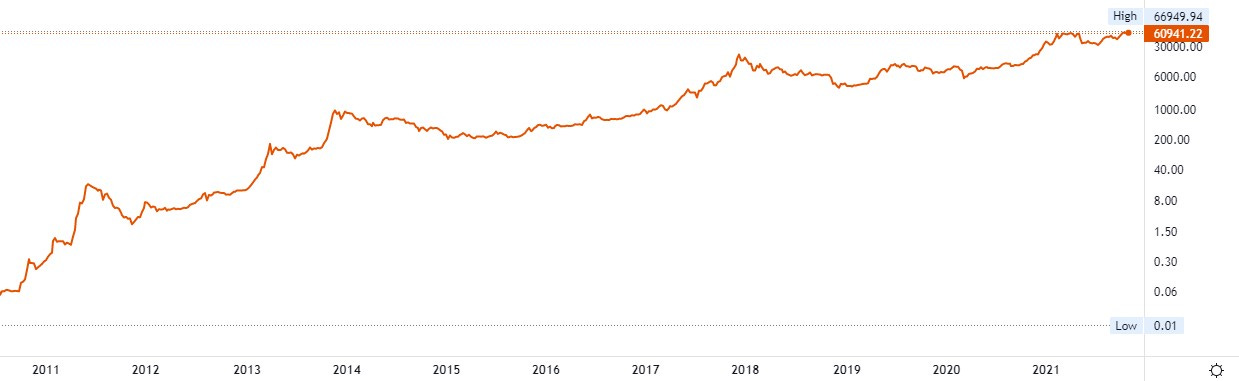

To put things into perspective, let’s zoom out of the Bitcoin price chart.

With this (very favorable) price structure in mind, and after thinking about your time preference, the last step to prepare is to consider scenarios for your plan. What could happen with Bitcoin that would make you want to act? I’ve compiled a list to help you get started:

What if I don’t have any Bitcoin and it continues its price growth over the years?

What if Bitcoin drops back to $50k in November?

What if Bitcoin has a blow-off top similar to 2013 and 2017 in December 2021 at around $200k and declines by 80% then?

What if Bitcoin continues to rise in price throughout the rest of 2021 and 2022?

I encourage you to decide your time preference and consider possible scenarios now. It will keep you in a position to make informed decisions even in the face of rampant price swings and overdramatized news that will, undoubtedly, come.

Do you know someone who could benefit from this week’s focus topic? Share The Bitcoin Espresso with them!

And if you haven’t yet, subscribe now to get a closer analysis of how a Bitcoin blow-off top could look like in next week’s Bitcoin Espresso Focus. I will keep covering decisive topics for the turbulent months ahead so you can be prepared and in control.

💡 Fundamentals Glossary

Altcoins ... Alternative cryptocurrencies to Bitcoin are called altcoins.

Dollar-Cost Averaging (DCA) ... investors buying Bitcoin in fixed intervals to reduce the impact of price swings and to avoid having to time the market

Fear of missing out (FOMO) … in the Bitcoin context often used with relation to missing out on profits from expected rising prices

Fear, uncertainty, and doubt (FUD) ... in the Bitcoin context commonly understood as misinformation to cause panic selling from investors

Federal Open Market Committee (FOMC) ... is the branch of the US Federal Reserve that determines the course of monetary policy.

Holdings ... The contents of an investment portfolio.

Do you want me to tackle a particular topic? Or do you want to tell me how The Bitcoin Espresso is doing? Send me your feedback so I can make this the best newsletter possible.

The Bitcoin Espresso does not constitute financial- or investment- advice, nor is it an offer or invitation to purchase any digital assets. You are solely responsible for your own investment decisions.

The Bitcoin Espresso is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance, or events that differ from those statements.