Welcome to this week’s The Bitcoin Espresso! Whether you’re interested in Bitcoin, have just bought your first fractions of Bitcoin, or want to dive deeper into the space — this newsletter is for you. Find out more about the motivation behind this newsletter in the introduction post.

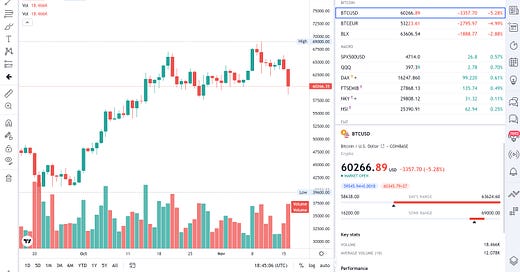

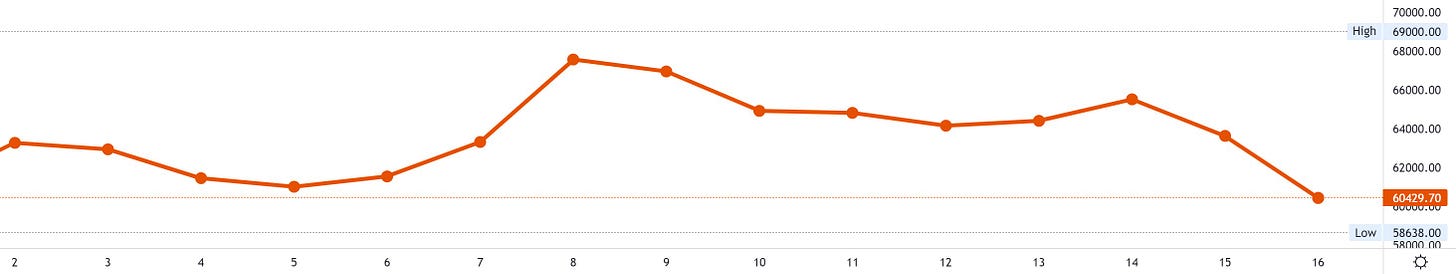

Weekly Summary: Bitcoin’s price came back down a little after last week’s new all-time high (ATH) and had a ~5% dip today. Today’s news will look into a probable cause for this — an exchange-traded fund having been rejected. If this dip has you worried, don’t forget to zoom out of your price chart to take in the bigger picture. How do I come by the opinion that this is unrelated to broader macroeconomic topics and that a more drastic weekly summary would be uncalled for? That’s the topic of today’s focus, where we introduce a tool to make sense of price movements.

A quick tip: There’s an explanation of words and abbreviations in the Fundamentals Glossary at the bottom.

📰 Essential News

SEC rejects Bitcoin ETF: The Securities and Exchange Commission (SEC) rejected the Bitcoin spot exchange-traded fund (ETF) request by VanEck. Edition #1 of this newsletter happily announced that the SEC approved an ETF. The difference for the VanEck ETF is that it would have held and tracked Bitcoin directly rather than derivative financial contracts like futures. The SEC seems to be more comfortable with futures-based ETFs because they trade on highly regulated exchanges.

Taproot went live: Taproot, the first Bitcoin core protocol upgrade in the last four years, was activated recently. It was agreed upon with a new speedy trial approach. Proposed changes had to be agreed upon or rejected by Bitcoin miners within three months without compromising safety in either case. Taproot brings more efficient transactions, increases privacy, and paves the way for smart contracts.

Coinbase Third Quarter (Q3) report: Coinbase, the largest U.S. cryptocurrency exchange, published a third-quarter letter to shareholders. The report contains metrics that we can use to get a better idea of the crypto market. Coinbase reports $1,235 million in revenues and $406 million in income. Monthly transacting users came down to 7.4 million from 8.8 million in Q2 but are still above Q1 numbers.

Want more news? Follow @thebitcoinespresso on Twitter to stay on top of things between newsletters.

🎯 Focus: Keeping an Eye on Bitcoin with TradingView

In the last edition of The Bitcoin Espresso, we took a closer look at a possible Bitcoin top. Regardless of how the situation will play out exactly, Bitcoin’s price will move considerably. How do you know if it’s a regular movement or something that requires your closer attention?

For this distinction, it is a significant advantage to follow the price. The longer you do, the more experience you gain with how Bitcoin reacts to its environment. This, in turn, reduces the chance for turbulence to catch you unawares.

In this focus, we’ll get started with TradingView, a tool I’ve used for years to follow the price, make sense of it and get automatic alarms. Consider registering with the following affiliate link to support my efforts and get up to $30 if you choose to go with an upgraded plan. Nevertheless, to follow this article, the free offer is sufficient.

TradingView is first and foremost a charting platform that offers a wide range of tools to make sense of different markets. This is beneficial even if you plan to solely invest in Bitcoin since this asset is nevertheless influenced by macroeconomic forces. Therefore, having an isolated view can skew your understanding of the situation. I’ve observed occasions where the broader markets were moving unfavorably, causing Bitcoin to follow suit. Bitcoin communities then wrongfully projected this solely on their favorite cryptocurrency.

Following the Price

To help you get started to expand your vision beyond the Bitcoin price ticker/symbol, you can copy the Bitcoin Espresso TradingView watchlist.

Press the Make a copy button to make this list your own and adapt it to your needs. Let’s take a closer look at the symbols of your new list.

Bitcoin

These symbols are for tracking the price of Bitcoin itself.

BTCUSD ... The most popular Bitcoin trading pair in the world trades between Bitcoin and the U.S. Dollar. The prices are fetched from the exchange Coinbase.

BTCEUR ... If you’re from a country that uses the euro, this might be a more intuitive symbol than BTCUSD. You can easily remove it from your watchlist if one or the other doesn’t apply to you.

BLX ... The BLX is another BTCUSD trading pair. However, it has one distinct advantage. The price data of this symbol reaches back to 2010 — perfect for comparing current price movements with previous halving cycles.

Macro

These symbols provide an overview of how the world markets are doing.

SPX500USD ... Standard & Poor’s 500 is one of the most followed stock market indices and consists of 500 large companies listed on American stock exchanges. It is considered one of the best representations of the U.S. stock market and a trend indicator for the U.S. economy.

QQQ ... tracks the Nasdaq-100 index, which includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization (≈ share price ⨉ number of shares outstanding). It is heavily allocated towards industries such as Technology, Consumer Services, and Health Care.

DAX ... index of the 30 biggest companies of the Frankfurt Stock Exchange

FTSEMIB ... index of 100 large market capitalization stocks of the London Stock Exchange

NKY ... index of 225 blue chip (reputed to be of high quality, reliable, and able to operate profitably in good and bad times) companies traded on the Tokyo Stock Exchange

HSI ... index of the 40 largest companies that trade on the Hong Kong Exchange

Fiat

These symbols show how a particular currency is doing for you to compare with Bitcoin.

DXY ... tracks the strength of the dollar against a basket of major currencies

USDEUR ... tracks the strength of the dollar against the euro. Feel free to switch this one for a symbol that’s most applicable to you

As you see, the list features the quintessential Bitcoin symbols and a way to check back on historical data. Furthermore, you have a few of the most popular trackers to get an overview of broader market movements. Observe the price movements for a while, and then add or remove symbols according to your needs.

With the above list, you can take a quick look and see Bitcoin moving with or against the broader markets. This allows you to discern if there is a particular reason that drives Bitcoin’s price.

Making Sense of the Price

Now that we’ve got our choice of symbols established, the next step is to switch to the advanced chart and learn to read candlesticks. By default, prices are usually depicted with lines. Lines are intuitive but hide essential information. For example, it can be a crucial indicator of the market sentiment if the price is highly contested and moves substantially during a chosen timeframe (say, a day). The line view cannot visualize this information, and this is where the candlestick shines.

For each timeframe (4 hours, 1 day,...), there is one candle. Beyond showing where the price started and ended in the timeframe, it also shows the highest and lowest price. It is much clearer in this visualization if the price is contested. Candlestick charts allow you to read this emotion in the market and can be used to determine possible price movement based on past patterns. You can switch to candles in the top left corner of the advanced chart in TradingView.

If you moved and zoomed around your graph, it might now be in an unhelpful configuration. In this case, take a look at the bottom right, where you can find an auto button that adjusts the scales to a good fit. Furthermore, you can switch to a logarithmic scale with the log button. A logarithmic scale is used when the price jumps a lot in a short time. After impactful moves, subsequent changes will be barely visible on an arithmetic scale, even if they still represent significant percentage gains or losses for your portfolio.

Last week we discussed that a Bitcoin blow-off top has historically coincided with considerable volume. Click on Indicators & Strategies and pick Volume to see red and green bars added to the bottom of your chart. The higher the bars, the more Bitcoin was traded in your currently chosen timeframe.

Get Automatic Alarms

Now, we have the tools to make sense of the price if the situation calls for it. Next, let’s add a little helper to notify us when we should take a look. Click on Alert and configure it like this:

Here’s the message text for you to comfortably copy it:

🔻 5% to ${{close}} (V {{volume}})Now, whenever Bitcoin moves by more than 5%, TradingView will notify you. The configuration of the alarms is subjective. My recommendation is to set them to be low-frequency enough to stay meaningful. If you notice yourself beginning to ignore them, set higher timeframes or percentages. If you missed critical situations because you didn’t get an alarm, tighten the conditions.

Done! Now, you have everything you need to follow the price, make sense of it and get automatic Bitcoin price alarms. TradingView has been a helpful companion in my Bitcoin journey, and I hope, with this introduction, it can be yours, too.

Do you know someone who could benefit from this week’s focus topic? Share this edition with them!

And if you haven’t yet, sign up for The Bitcoin Espresso now!

💡 Fundamentals Glossary

Crypto … Common abbreviation of the whole cryptocurrency space, which goes beyond digital currencies and also spans across decentralized finance (DeFi), non-fungible tokens (NFTs), and many other innovations.

Cryptocurrency … A digital currency that uses cryptography to prevent counterfeiting and fraudulent transactions. There are other cryptocurrencies besides Bitcoin.

Exchange Traded Fund (ETF) … An exchange traded fund is a selection of financial assets that can be traded on an exchange. It usually follows an index, sector, commodity, or other assets (such as Bitcoin).

Futures … Futures are agreements to buy or sell an asset such as Bitcoin at a predefined price on or before a later date.

Market Capitalization (Market Cap) ... refers to the total price of a company’s outstanding stock shares (≈ current share price ⨉ number of shares).

Securities and Exchange Commission (SEC) … The SEC is an agency of the US government with the primary purpose to enforce the law against market manipulation.

Do you want me to tackle a particular topic? Or do you want to tell me how The Bitcoin Espresso is doing? Send feedback or comment on this post so I can make this the best newsletter possible.

The Bitcoin Espresso does not constitute financial- or investment- advice, nor is it an offer or invitation to purchase any digital assets. You are solely responsible for your own investment decisions.

The Bitcoin Espresso is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness, or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance, or events that differ from those statements.