The Bitcoin Espresso ☕#3 — A Bitcoin Blow-Off Top in Detail

New ATH & Bitcoin Blow-Off Top in Detail

Welcome to this week’s The Bitcoin Espresso! Whether you’re interested in Bitcoin, have just bought your first fractions of Bitcoin, or want to dive deeper into the space — this newsletter is for you. Find out more about the motivation behind this newsletter in the introduction post. Want more news? Follow @thebitcoinespresso on Twitter to stay on top of things between newsletters.

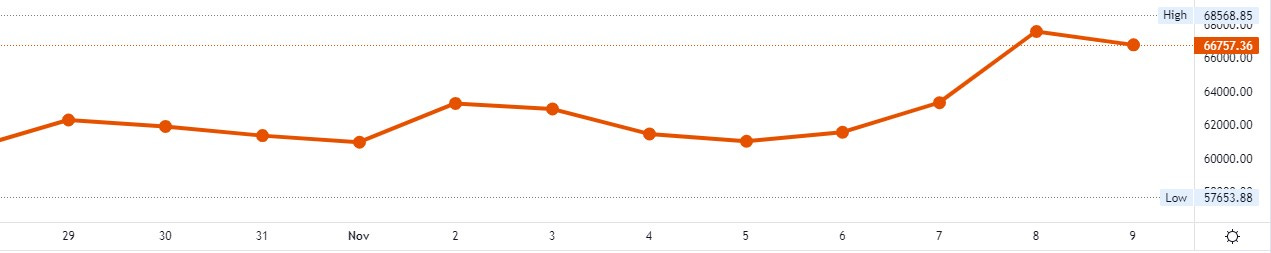

Weekly Summary: Bitcoin’s price reached a new all-time high (ATH) of around $68,000! Today’s newsletter provides some thoughts on what that means, talks about Coinbase accepting BTC as collateral, and Mastercard’s steps to further support cryptocurrencies. The focus topic of this edition considers how a possible BTC price top could look.

A quick tip: There’s an explanation of words and abbreviations in the Fundamentals Glossary at the bottom.

📰 Essential News

New Bitcoin All-Time High (ATH): Bitcoin has reached a new price record today and has passed the market capitalization (≈ price ⨉ Bitcoin in circulation) of the Swiss Franc. If you purchased and held Bitcoin at any point before today, your investment is now in profit. If you bought the price dip around July, you’re already up by ~100%.

Coinbase accepting BTC collateral: Coinbase, a popular U.S crypto exchange, accepts Bitcoin as collateral for loans in selected U.S states now. Users that want cash but avoid selling their Bitcoin because it’s a taxable event in most countries could appreciate this new offer. Loans are a service traditionally offered by banks, so it’s interesting to see Coinbase entering that market sector.

Mastercard & Crypto: Mastercard followed up on their announcement to bring crypto to its network. There’s a rumor that they will announce that merchants can accept cryptocurrencies soon. Furthermore, they’ve just launched a payments card in the Asia Pacific that allows users to pay with cryptocurrencies for merchants that don’t accept it yet. These continued initiatives will reduce friction when using cryptocurrencies for payments.

🎯 Focus: A Bitcoin Blow-Off Top in Detail

In the last two newsletters, we have considered the importance of the halving cycle for Bitcoin’s price and how you formulate your plan for the turbulent weeks and months ahead. Now, we can take an informed look at the most discussed topic in the Bitcoin space at the moment. Will Bitcoin have another blow-off top, or will this be the last cycle/a supercycle?

To form our own opinion, we need to know more about the discussed price movements. Bitcoin’s price shifts considerably, so it’s hard to distinguish the top from Bitcoin’s regular shenanigans. A blow-off top shows a rapid price increase during which you can expect significant FOMO. Then, a steep drop follows. Both movements tend to happen with high volume, the amount of Bitcoin traded per time period. In the past two halving cycles, blow-off tops marked the start of bear markets that brought Bitcoin down by ~80%.

This description has been rather abstract so far, so let’s take a look at the actual tops from 2013 and 2017.

As you can see, both cycles had a price pullback shortly before the top. The local top before this pullback, if it happens again, will be misidentified as the top by many investors. Then, Bitcoin has another incredible rally to the blow-off top before it cracks with force in the other direction.

When Bitcoin begins its downtrend, it might be interrupted by brief periods of recovery. Bitcoin’s price rises, and investors start buying again with the expectation of the bull run to continue. Nevertheless, the price doesn’t reach the price levels of the prior blow-off top and continues its prolonged decline.

Consider indicators that your idea of the situation is wrong rather than right. What if the price climbs back up dangerously close to the point you identified as blow-off top? In this case, Bitcoin might very well continue a walk to higher prices in a last-cycle/supercycle scenario. What if the supposed last pullback before the top starts to look dangerously like an actual blow-off top? Thinking like this keeps you grounded and prepares you for these emotional situations.

Knowing about the past cycles is a powerful help, but you shouldn’t blindly assume that history will repeat itself. Nevertheless, you can prepare well in case it rhymes.

In my opinion, no introductory discussion about the Bitcoin top is complete without showing the psychology of a market cycle cheat sheet. It displays a striking resemblance to the Gartner hype cycle. The cheat sheet conveys an idea of the sentiment you could observe — or experience yourself — at particular times in the market cycle.

You’re now ready to follow the current discussion of what Bitcoin will do next. Take the time to contemplate how different events will affect your plan and how you want to act in specific situations. To dive deeper, I can wholeheartedly recommend this video by Benjamin Cowen & Jordan Lindsey. They discuss today’s topic in more depth and give helpful advice for investors looking to trade these price scenarios. For more perspectives, this video with Will Clemente, PlanB, and Willy Woo is ideal. They discuss the topic from a different angle and have distinctive outlooks for the short to medium timeframe. What both videos share is a fundamental belief in Bitcoin for the long term.

I hope this week’s focus topic has provided you with the necessary background to follow the Bitcoin cycle top discussions. For the upcoming editions of The Bitcoin Espresso, you can expect further focus topics in the trading-related categories. I believe this is the most critical category at the current time of the market cycle.

Next week, we’ll look into helpful tools to keep a closer eye on the Bitcoin price to avoid a possible top from catching us unawares.

Do you know someone who could benefit from this week’s focus topic? Share The Bitcoin Espresso with them!

And if you haven’t yet, subscribe now!

💡 Fundamentals Glossary

Bearish ... Pessimistic about higher prices of an asset or the prospects of a company/person/...

Crypto … Common abbreviation of the whole cryptocurrency space, which goes beyond digital currencies and also spans across decentralized finance (DeFi), non-fungible tokens (NFTs), and many other innovations.

Cryptocurrency … A digital currency that uses cryptography to prevent counterfeiting and fraudulent transactions. There are other cryptocurrencies besides Bitcoin.

Fear of missing out (FOMO) … in the Bitcoin context often used with relation to missing out on profits from expected rising prices

Volume … the amount of Bitcoin traded per time period

Do you want me to tackle a particular topic? Or do you want to tell me how The Bitcoin Espresso is doing? Send feedback or comment on this post so I can make this the best newsletter possible.

The Bitcoin Espresso does not constitute financial- or investment- advice, nor is it an offer or invitation to purchase any digital assets. You are solely responsible for your own investment decisions.

The Bitcoin Espresso is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness, or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance, or events that differ from those statements.