The Bitcoin Espresso ☕#9 — Huobi Selling Pressure & Bitcoin is Disruptive Innovation

Welcome to this week’s The Bitcoin Espresso! Whether you’re interested in Bitcoin, have just bought your first fractions of Bitcoin, or want to dive deeper into the space — this newsletter is for you. Find out more about the motivation behind this newsletter in the introduction post. Want more news? Follow @thebitcoinespresso on Twitter to stay on top of things between newsletters.

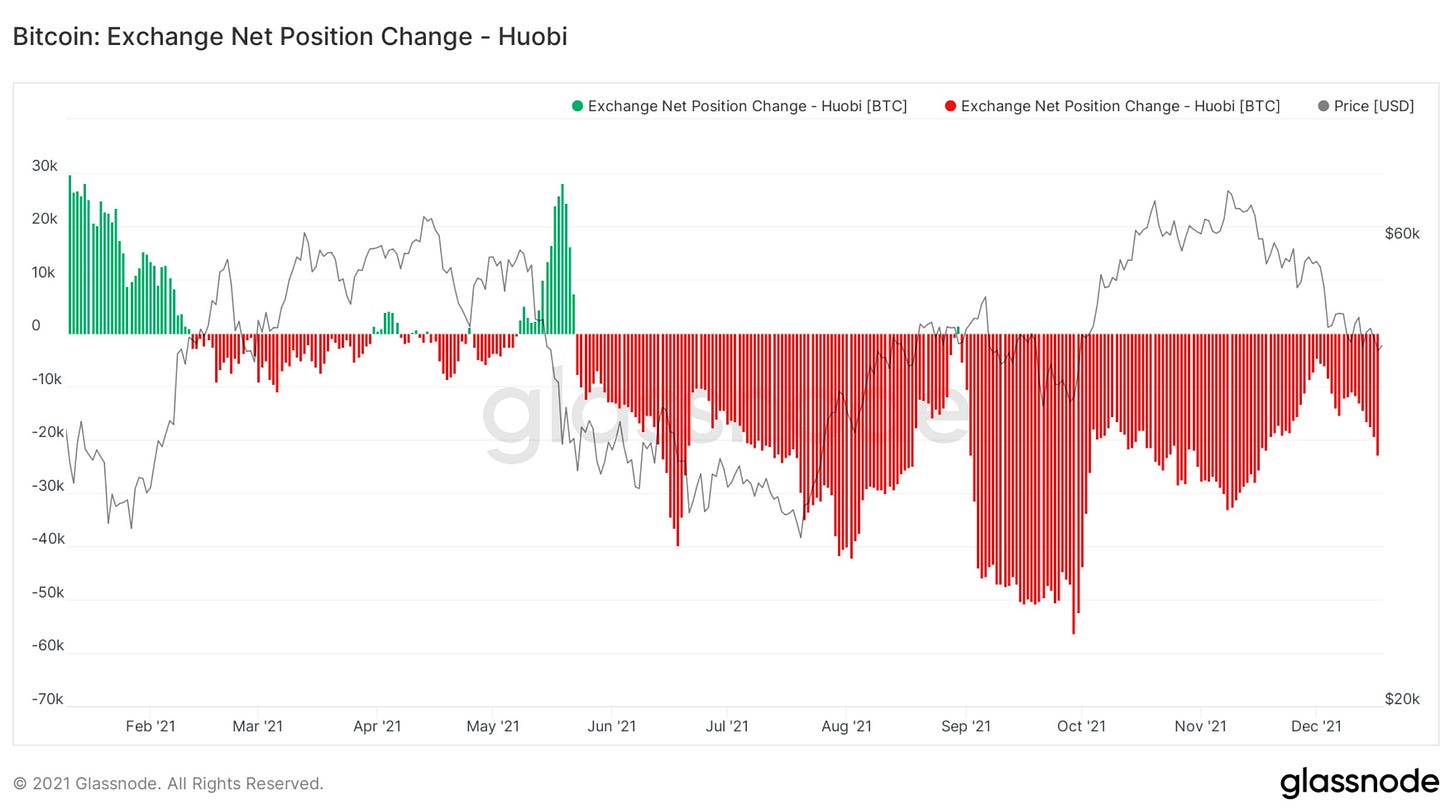

Weekly Summary: Bitcoin’s price is currently consolidating below the last all-time high (ATH). Huobi stopping cryptocurrency trading for Mainland China users could be a relevant factor in that regard. A German bank shows us how the sector could embrace Bitcoin and the computing power of the Bitcoin network is back to where it was before a nation-state attacked it. Today’s focus article looks at why Bitcoin is seen as such a revolutionary innovation by its advocates.

A quick tip: There’s an explanation of words and abbreviations in the Fundamentals Glossary at the bottom.

📰 Essential News

Huobi Limited Trading in China: Huobi, Asia’s largest cryptocurrency exchange, has stopped allowing (spot) trading for Mainland China users last week. Users had their buy orders canceled and must sell or withdraw their Bitcoin before Dec 31st. This extended crackdown from China has led to considerable selling pressure.

German Bank Educating all Employees on Bitcoin: The German ‟Volksbank Raiffeisenbank Bayern Mitte″ educated their 800 employees on Bitcoin. They state that large parts of the public discuss Bitcoin and want to support customers with the topic. Their efforts include educating customers about Bitcoin, helping them with trading and safekeeping. I can see that such offers make sense for the bank sector since getting started with Bitcoin still takes a considerable effort, and directly transacting with Bitcoin might not be accessible for some customers.

Bitcoin Mining has Recovered after Crackdown: Bitcoin mining was banned from China earlier this year. Since this nation-state attack on Bitcoin, the computing power of the miners in the Bitcoin network has fully recovered only 6 months later. Bitcoin miners moved to different parts of the world to resume operations there. This increased distribution means a higher resilience of the Bitcoin network against future attacks and is, therefore, advantageous for Bitcoin. If you’re wondering why decentralization is so important, check out The Bitcoin Espresso focus article on the topic.

🎯 Focus: Bitcoin is Disruptive Innovation

Bitcoin is often discussed purely from an economic perspective. This surprises me since I consider it an invention with an impact beyond an investment opportunity. My opinion is that Bitcoin is an innovation in computing the likes of which we haven’t seen since the internet and smartphones. This article gives a perspective motivated by my background in computer science and entrepreneurship, which is the root of my belief in Bitcoin. If you’re unsure of the meaning of the double-spending problem, I encourage you to first read the focus article in edition #6 of The Bitcoin Espresso.

Not all innovations are created equal. Sometimes, innovation is just a marketing term to sell minor improvements to previously established products. But occasionally, innovation is disruptive. Disruptive innovations create new markets and displace established enterprises and products. Consider the introduction of smartphones, which were more capable than earlier phones and paved the way for unique business opportunities, use cases, and services. Smartphones solved problems that we didn’t know we had before they were prevalent.

In computer science, solving problems has a meaning beyond its common use. Alan Turing is considered the father of theoretical computer science. He provided a formalization of the concepts of algorithm and computation. We call a programming language Turing-complete if it is theoretically capable of expressing all tasks accomplishable by computers. The emphasis here lies on all rather than a specific set of tasks. Bear with me for a bit longer.

An algorithmic problem is a problem of finding a method to solve an infinite series of individual problems of the same type. You can say that a problem A is reducible to problem B if an algorithm for solving problem B efficiently could also be used to solve problem A efficiently. Say you have a hard-to-solve problem, but transform it in a way to make it look like an easy problem you know how to solve, then it becomes easy-to-solve. So you see, solving problems can be accompanied by meaningful phrases such as all or an infinite number in computer science.

Now, how does Bitcoin relate to this? I believe that Satoshi Nakamoto has found a decentralized solution to all problems that can be reduced to a double-spending problem. This means it wasn’t just a solution to one specific theoretical issue. Solving the double-spending problem unlocked a whole world of new possibilities. It’s an upgrade to the entire internet. It paves the way for new products, services, and markets that weren’t viable before — disruptive innovation.

A commonplace critique of Bitcoin is that it doesn’t provide enough tangible value right now. This argument surprises me, especially when coming from people that have experienced the internet in the 1990s. You probably wouldn’t have expected the internet to be used to stream 4K movies without issues at a time when just loading a single picture on a website took minutes. We were warned that all internet shopping was a scam and that we would lose our money before Amazon came along. Alan Turing, while standing in front of computing machines weighing tons, certainly didn’t foresee me sending a newsletter about a digital currency through a global computer network to personal computers the size of a hand that the majority of the world owns. Bitcoin is clearly at a technological refinement comparable to the internet in its 1990s phase. Most of its use-cases will only emerge with more time.

The cryptocurrency space is already producing innovations at a tremendous speed. We came from having the Bitcoin network established in 2009 to having more than 8000 Altcoins and trends like NFTs, Dapps, DeFi, the metaverse, DAOs, or Web 3.0. Who knows what else we’ll see?

To conclude, solving the double-spending problem meant more than solving an obscure theoretical issue — it started a disruptive innovation process. I’m glad you’re along for the ride.🚀

🎄With the holidays coming up, some of you will be involved in Bitcoin talk. Especially new people need to learn a lot to catch up with the space. To help them (or gracefully exit a family Bitcoin talk that has gone on for too long), I’d be happy if you could let them know about The Bitcoin Espresso. Happy holidays!🎄

And if you haven’t yet, sign up for The Bitcoin Espresso now!

Can’t get enough of reading newsletters? Check out The Sample 💌, which sends you newsletter recommendations based on your interest.

💡 Fundamentals Glossary

Altcoins ... Alternative cryptocurrencies to Bitcoin are called altcoins.

ATH … Short for All-Time High. The highest price achieved so far. Every person who has ever bought Bitcoin and held it until the ATH is in profit at that point.

Cryptocurrency … A digital currency that uses cryptography to prevent counterfeiting and fraudulent transactions. There are other cryptocurrencies besides Bitcoin.

Futures … Futures are agreements to buy or sell an asset such as Bitcoin at a predefined price on or before a later date.

Spot Trading ... For cryptocurrency exchanges, usually means the immediate, direct trade of the cryptocurrency rather than through a derivative like futures.

Do you want me to tackle a particular topic? Or do you want to tell me how The Bitcoin Espresso is doing? Give feedback or comment on this post to make this the best newsletter possible.

The Bitcoin Espresso does not constitute financial- or investment- advice, nor is it an offer or invitation to purchase any digital assets. You are solely responsible for your own investment decisions.

The Bitcoin Espresso is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness, or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance, or events that differ from those statements.