The Bitcoin Espresso ☕ #7 — Bloody Saturday & Taxes

Welcome to this week’s The Bitcoin Espresso! Whether you’re interested in Bitcoin, have just bought your first fractions of Bitcoin, or want to dive deeper into the space — this newsletter is for you. Find out more about the motivation behind this newsletter in the introduction post. Want more news? Follow @thebitcoinespresso on Twitter to stay on top of things between newsletters.

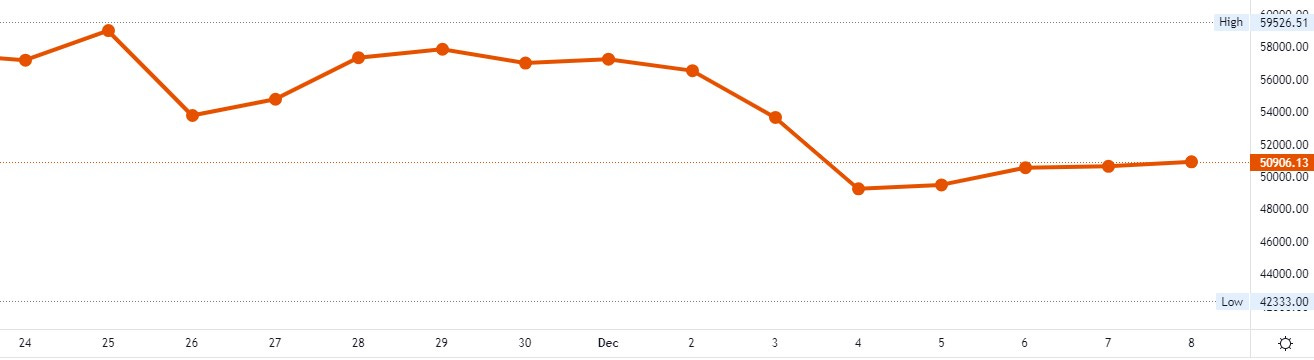

Weekly Summary: Bitcoin’s price continued through Black Friday to Bloody Saturday in a pessimistic sentiment that has slightly recovered since then. Grayscale released a research report providing insightful data on the Bitcoin environment, and Forbes ran an article about how Bitcoin could fix Turkey’s currency crisis. Today’s coffee chat talks about what you could do with your altcoins if you would have to sell them at a loss.

A quick tip: There’s an explanation of words and abbreviations in the Fundamentals Glossary at the bottom.

📰 Essential News

Bloody Saturday: Bitcoin took quite a hit and brought along other cryptocurrencies with it on Saturday. The fear & greed index (see The Bitcoin Espresso #2) fell to ‟Extreme Fear″, reflecting a pessimistic sentiment. The sell-off is argued to have come from the leverage market, where the same amount of money is used to make a larger investment. In a nutshell, too many highly leveraged open trades can collapse with a sudden flush. This phenomenon has brought price jumps to Bitcoin in the past, so I consider it a reasonable argument. Price and sentiment have slightly recovered since then at the time of writing.

Bitcoin & Lira: With inflation running hot in Turkey, Forbes recently published an article titled Bitcoin Could Fix Turkey’s Currency Crisis. This is quite a story for a magazine of that size. Turkey has ‟banned Bitcoin″ in April, and Bitcoin has appreciated considerably against the lira since then. You can see how the conversion rate developed with a Google search (switch to YTD, year-to-date). Bitcoin is often seen as an inflation hedge by investors and developments like these strengthen that view.

Grayscale 2021 Bitcoin Investor Study: Grayscale has released the results of their online survey with 1000 U.S. consumers between ages 25 and 64. According to the study, 26% of investors already own Bitcoin, and 55% began investing in the last 12 months, with concerns about Bitcoin trending towards a more positive conception across the board. You have likely noticed that news about Exchange-Traded Funds (ETFs) are frequent here, and apparently with good reason — 77% of investors say that they would be more likely to invest in Bitcoin if an ETF existed. I love data sets like these because they allow for a more objective view of the Bitcoin environment. Get the full report here.

🛋️ Coffee Chat: Tax-Loss Harvesting

A Bitcoin Espresso reader recently asked what to do with altcoins that dropped in value considerably since they purchased them. Particularly before the tax year ends, it’s worthwhile knowing how to make the best of a situation like that by using a tax optimization strategy called ‟Tax-Loss Harvesting″. The idea is that if you have to pay taxes because you sold an asset like Bitcoin for a profit, you can reduce these taxes by selling others for a loss and come away with more cryptocurrencies than before for the same total investment.

Be aware that the tax situation in your country is crucial for this optimization. Especially check if this practice is considered a wash sale for you and you might have to do this slightly differently if the taxes you pay are influenced by other factors such as holding periods (short-term/long-term) or tax brackets.

Here’s a summary of how tax-loss harvesting works:

Sell Bitcoin (or other assets) for a profit to realize gains. These gains will be taxed.

Sell other assets for a loss to realize losses. These losses reduce the gains and, therefore, the taxes you would pay for them.

Use the money you got back from selling at a loss, as well as the money you saved by reducing your tax burden, to buy assets.

I thought about writing an example in detail, but I believe you should find an article specific to your country and talk this through with your tax advisor to be on the safe side. For making the necessary calculations a lot easier, I recommend using Accointing.com (this affiliate link nets you a 10% discount and supports this newsletter ♥️):

I’ve happily used Accointing myself for a few years and counting. Their software has saved me considerable time and headaches and they have an article about tax-loss harvesting specific to the U.S. We’ll likely take a look at taxes in more detail another time, but I wanted to tell you about tax-loss harvesting now, so you still have some room to make your choices in this tax year.

Do you know someone who would like The Bitcoin Espresso? Share it with them!

And if you haven’t yet, sign up now!

Can’t get enough of reading newsletters? Check out The Sample 💌, which sends you newsletter recommendations based on your interest.

💡 Fundamentals Glossary

Altcoins ... Alternative cryptocurrencies to Bitcoin are called altcoins.

ETFs ... An exchange-traded fund is a selection of financial assets that can be traded on an exchange. It usually follows an index, sector, commodity, or other assets (such as Bitcoin).

Cryptocurrencies … A digital currency that uses cryptography to prevent counterfeiting and fraudulent transactions. There are other cryptocurrencies besides Bitcoin.

Do you want me to tackle a particular topic? Or do you want to tell me how The Bitcoin Espresso is doing? Give feedback or comment on this post to make this the best newsletter possible.

The Bitcoin Espresso does not constitute financial- or investment- advice, nor is it an offer or invitation to purchase any digital assets. You are solely responsible for your own investment decisions.

The Bitcoin Espresso is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness, or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance, or events that differ from those statements.