The Bitcoin Espresso ☕ #8 — FOMC Meeting, Sparkasse, Whatsapp & Bastion’s Commodity Views

Welcome to this week’s The Bitcoin Espresso! Whether you’re interested in Bitcoin, have just bought your first fractions of Bitcoin, or want to dive deeper into the space — this newsletter is for you. Find out more about the motivation behind this newsletter in the introduction post. Want more news? Follow @thebitcoinespresso on Twitter to stay on top of things between newsletters.

Weekly Summary: Bitcoin’s price has taken further hits in anticipation of the upcoming Federal Open Market Committee (FOMC) meeting. German Banks plan to offer cryptocurrency services, and WhatsApp runs a pilot for cryptocurrency payments. In today’s coffee chat I’m happy to bring you an interview with Bastion from Bastion’s Commodity Views, a newsletter that discusses Bitcoin’s price in detail.

A quick tip: There’s an explanation of words and abbreviations in the Fundamentals Glossary at the bottom.

📰 Essential News

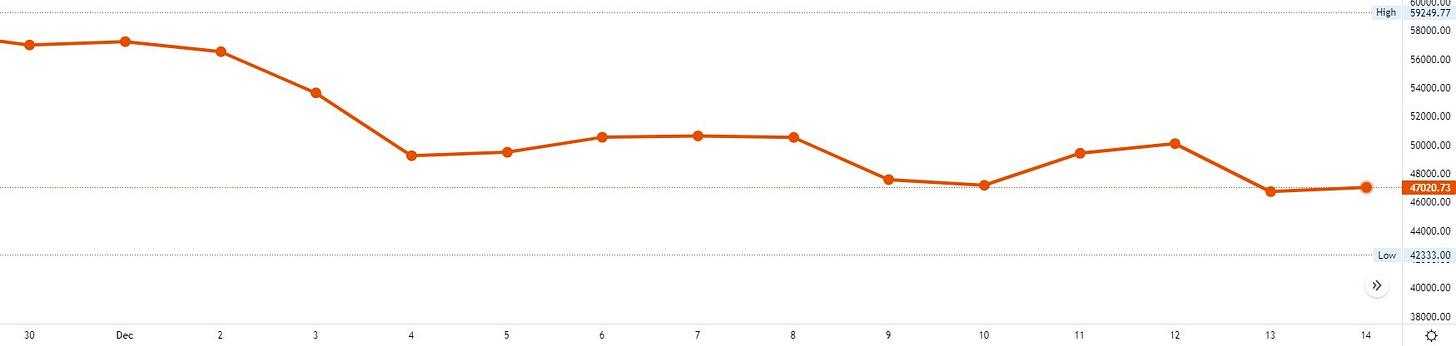

FOMC Meeting Tomorrow: The Federal Open Market Committee (FOMC), which determines the course of the US monetary policy, has a highly anticipated meeting tomorrow. Investors will be watching closely to see how the FOMC plans to tackle the high inflation. The latest US consumer price index (CPI) data shows an annual inflation of 6.8%. Risk assets such as Bitcoin might be hit if tapering, such as slowed asset purchases, is accelerated.

German Banks & Cryptocurrencies: Multiple German banks plan to make buying, selling, and holding cryptocurrencies easier for their customers. Sparkasse is reported to consider letting its 50 million customers buy cryptocurrencies directly from their checking accounts. Commerzbank, Volksbank, and Raiffeisenbank seem to be working on the topic as well. I’m always happy for an easier on-ramp for newcomers, and I didn’t expect early initiatives from this sector.

WhatsApp launches Crypto Payment Pilot: WhatsApp has launched a pilot project that allows a number of US users to pay with cryptocurrencies directly from the app. WhatsApp is owned by Meta (formerly Facebook) and uses their digital wallet Novi for this feature. The solution is advertised to make sending money to family and friends as easy as sending a message and with considerably lower fees than traditional methods. It gives us a glimpse of what cryptocurrencies will inevitably bring to our daily lives.

🛋️ Coffee Chat with Bastion

Bitcoin Espresso readers frequently ask me to provide insights on how Bitcoin’s price will develop. While I tend to hint at my opinion, I focus on utilizing my software engineering and entrepreneurial background to your best advantage — bringing you Bitcoin fundamentals and essential news so you can save time, stay in control, and be on top of Bitcoin.

Nevertheless, I wanted to provide you with a source that discusses Bitcoin’s price in more detail and goes beyond click-bait titles or catchy phrases. I have found Bastion’s Commodity Views, and have talked to Bastion to allow you to get an idea of what his newsletter is about. Without further ado, here’s my interview with Bastion.

What do you write about in Bastion’s Commodity Views?

“There seems to be limited information online associated with commodity valuations or forecasts, and I wanted to fill that void. My newsletter offers analysis coming from fundamental supply and demand assessments. While my professional experience includes mostly energies and grains, I had always appreciated Bitcoin in a very big way, and it is an important part of Bastion’s Commodity Views.”

You have a professional background in commodity trading. How does that influence your perspective on Bitcoin?

“From a top-down view of Bitcoin, it fits into the category of energy commodities very well to me. On the supply side, you have producers (miners) who consistently adjust production rates with respect to expected profit margins, which makes longer-term valuation fairly simple to estimate. At the same time, short-term Bitcoin demand is often heavily influenced by GDP growth just like crude oil. Therefore, it was an easy expansion for me to add Bitcoin into the existing basket of assets I analyse. It has certainly been a very positive move for my personal growth.”

There’s a lot of Bitcoin trading discussions on the internet. What is your approach to reason about Bitcoin’s valuation?

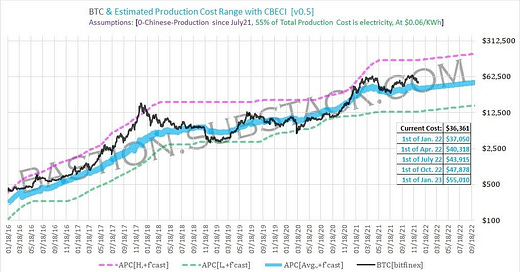

“With commodities, intrinsic value is usually determined by the average marginal cost of production, and the lower end of the cost range naturally becomes a price floor. This occurs since rational producers would reduce production if it is at a loss, therefore reducing supply with respect to demand (it is slightly more complex than this but that is the gist). From my standpoint, this absolutely applies to Bitcoin.

With the average production cost or intrinsic value estimated, it becomes easy to approximate future fair values based on expected USD depreciation and future mining difficulty adjustments. We can see that the lower end of the range has served as price floors around Dec. 18 and Mar. 20; and the logical fair value (which serves as a price magnet) is somewhere in the upper half of the production range since miners deserve a fair profit margin. Investing becomes easy when you have an idea of where the price magnet is.”

Why should The Bitcoin Espresso readers subscribe to Bastion’s Commodity Views?

“Readers can expect to see creative and little-discussed ideas around commodity, Bitcoin valuations, forecasting, and relevant statistical methods. I want to show readers stuff that they find interesting, useful, and may have never seen before.”

Do you know someone who would like The Bitcoin Espresso? Share it with them!

And if you haven’t yet, sign up for The Bitcoin Espresso now!

Can’t get enough of reading newsletters? Check out The Sample 💌, which sends you newsletter recommendations based on your interest.

💡 Fundamentals Glossary

Commodity ... A good used in commerce that is interchangeable with other goods of the same type. Commodities are often used for the production of other goods or services.

Cryptocurrency … A digital currency that uses cryptography to prevent counterfeiting and fraudulent transactions. There are other cryptocurrencies besides Bitcoin.

Federal Open Market Committee (FOMC) ... An institution that determines the course of the US monetary policy.

Mining (Bitcoin) ... The CPU (processing power) intense activity to process transactions in the Bitcoin network to get rewarded in Bitcoin.

Tapering ... Efforts by central banks to control interest rates, such as slowing down asset-purchases.

Do you want me to tackle a particular topic? Or do you want to tell me how The Bitcoin Espresso is doing? Give feedback or comment on this post to make this the best newsletter possible.

The Bitcoin Espresso does not constitute financial- or investment- advice, nor is it an offer or invitation to purchase any digital assets. You are solely responsible for your own investment decisions.

The Bitcoin Espresso is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness, or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance, or events that differ from those statements.