Welcome to The Bitcoin Espresso! ☕ Whether you’re interested in Bitcoin, have just bought your first fractions of Bitcoin, or want to dive deeper into the space — this newsletter is for you. Find out more about the motivation behind this newsletter in the introduction post.

Weekly Summary: Bitcoin’s price recently reached a new ATH (all-time high) on Oct 20th after a 189 day consolidation period. This sudden price movement started discussions on how the price will further develop. Read on to get a look into what’s behind these discussions, and check out this week’s Focus about the importance of Halving Cycles for Bitcoin.

A quick tip: There’s an explanation of words and abbreviations in the Fundamentals Glossary at the bottom.

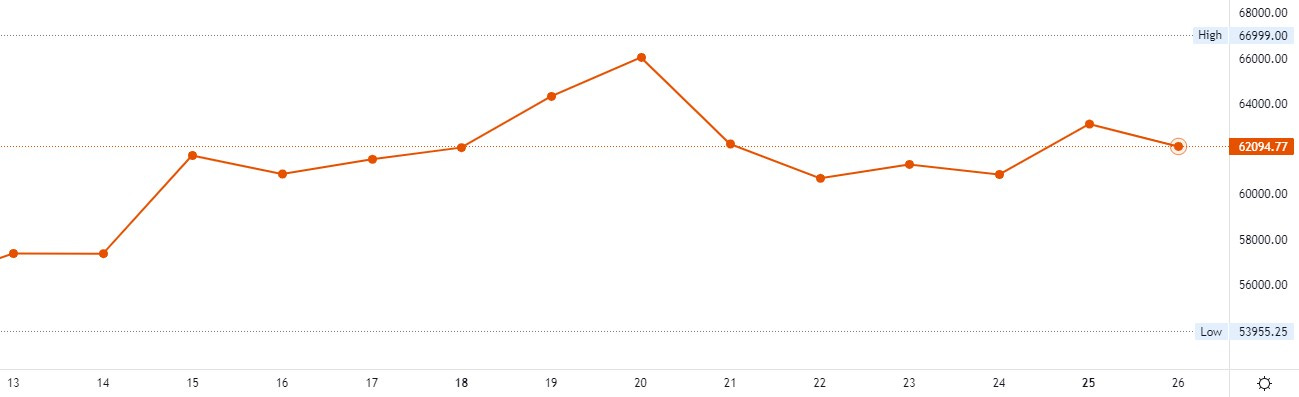

Price Update: The price of Bitcoin moved between a low of $54k on Oct 13th and a new all-time high of $67k on Oct 20th in the last two weeks.

📰 Essential News

SEC approves Bitcoin ETF: One of the main drivers for the recent price increase was the news that the Securities and Exchange Commission (SEC) approved a Bitcoin futures exchange-traded fund (ETF). This means that a US agency tasked with enforcing the law against market manipulation has approved a financial Bitcoin product on one of the biggest and oldest stock exchanges in the world. This is certainly noteworthy, especially because similar applications have been rejected in the past. This new ETF gives investors the ability to participate in the Bitcoin market in a more regulated way compared to buying Bitcoin directly and will likely bring more market participants.

IMF Global Financial Stability Report: The IMF (International Monetary Fund), an institution of the United Nations looking to secure financial stability amongst other goals, has released a report with a dedicated 18-page chapter about cryptocurrencies. They argue that crypto has both opportunities as well as challenges and state that the “technological innovation is ushering in a new era that makes payments and other financial services cheaper, faster, more accessible and allows them to flow across borders swiftly.” Even the IMF seems bullish on crypto nowadays. Nevertheless, they advocate for global standards for crypto-assets amongst other regulatory suggestions. They seem focused on the risk of stablecoins, question their stability, and argue for more disclosure and auditing. The report is a good read with plenty of informative graphs for you to dive deeper into possible future regulations.

Bitcoin “Taproot” upgrade coming soon: The next Bitcoin upgrade defined by the Bitcoin Improvement Proposal 343 named “Taproot” will take effect in about 21 days. It has previously reached worldwide consensus and will bring more efficient transactions, increase privacy, and pave the way for smart contracts. Since this is the first upgrade to the Bitcoin core protocol in the last four years - and one with significant improvements - we can expect this to stir up curiosity.

🎯 Focus: Halving Cycles

There can only ever be 21 million Bitcoin. Roughly every four years, the amount of new coins being created is halved - an event called the halving. The idea is that a reduction of new Bitcoins created combined with increased demand leads to higher prices. This is why Bitcoin is often described as being deflationary by design.

For a more vivid comparison, imagine what would happen to the price of gold if half of the world’s gold mines collapse every four years.

This comparison has its merits because Bitcoin is often described as a store of value (SoV), a property commonly assigned to gold. A prevalent model to be considered in this context is Plan B’s Stock To Flow Model. It compares Bitcoin’s stock, the size of the existing stockpiles or reserves of Bitcoin, and its flow, the yearly production, to commodities such as gold or silver. The model continues to hold up well and strengthens the arguments for halving events to have a considerable impact on the price of Bitcoin.

Let’s see how the halvings affect the Bitcoin price by consulting the @halvingtacker. It shows how the price of Bitcoin developed in a comparison between 2012, 2016, and the current cycle.

As you can see, a halving event kicked off a Bitcoin bull run in 2012 and 2016. Most analysts would agree that we are currently in one as well. How this cycle is going to play out is where analysts begin to have controversial discussions. One idea is that Bitcoin is nowadays more established, has garnered more institutional investors, and is an attractive inflation hedge. This belief is referred to as being in a Bitcoin “supercycle” and implies that we will see less of a price pullback than the previous cycles have had. The other belief is that we will experience another sharp price uptake before reaching a peak followed by a spectacular price drop, a so-called blow-off top, just like the 2012 and 2016 cycles have had. Regardless of how the price of Bitcoin will develop, the best thing you can do to prepare is to have a plan, a topic we will tackle in next week’s Bitcoin Espresso Focus.

If you liked this edition of The Bitcoin Espresso consider sharing it.

Do you want me to tackle a particular topic? Do you think some aspects of The Bitcoin Espresso can be improved? Or do you just want to tell me how I’m doing? Send me your feedback so I can make this the best newsletter possible.

💡 Fundamentals Glossary

ATH … Short for All-Time High. The highest price achieved so far. Every person who has ever bought Bitcoin and held it until the ATH is in profit at that point.

Bullish … Optimistic about higher prices of an asset or the prospects of a company/person/...

Crypto … Common abbreviation of the whole cryptocurrency space, which goes beyond digital currencies and also spans across decentralized finance (DeFi), non-fungible tokens (NFTs), and many other innovations.

Cryptocurrency … A digital currency that uses cryptography to prevent counterfeiting and fraudulent transactions. There are other cryptocurrencies besides Bitcoin.

Exchange Traded Fund (ETF) … An exchange traded fund is a selection of financial assets that can be traded on an exchange. It usually follows an index, sector, commodity, or other assets (such as Bitcoin).

Futures … Futures are agreements to buy or sell an asset such as Bitcoin at a predefined price on or before a later date.

Halving Cycle … Roughly every four years, the amount of new Bitcoins that are created is halved. This is called the Bitcoin halving. The time between Bitcoin halvings is referred to as a halving cycle.

Securities and Exchange Commission (SEC) … The SEC is an agency of the US government with the primary purpose to enforce the law against market manipulation.

Stablecoin … A cryptocurrency that aims to maintain the value of a specific asset (often the US dollar).

The Bitcoin Espresso does not constitute financial- or investment- advice, nor is it an offer or invitation to purchase any digital assets. You are sorely responsible for your own investment decisions.

The Bitcoin Espresso is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events which differ from those statements.