The Bitcoin Espresso ☕#14 — KPMG Purchased Bitcoin, The Lightning Network⚡

Welcome to this week’s The Bitcoin Espresso! Whether you’re interested in Bitcoin, have just bought your first fractions of Bitcoin, or want to dive deeper into the space — this newsletter is for you. Find out more about the motivation behind this newsletter in the introduction post. Want more news? Follow @thebitcoinespresso on Twitter to stay on top of things between newsletters.

Weekly Summary: Bitcoin’s price recovered nicely with lots of bullish news and rumors over the last week. KPMG Canada purchased Bitcoin, Cash App enabled Lightning for all users, and $3.6 billion in Bitcoin allegedly stolen by a cringe-rapper were recovered. Today’s focus topic is the Bitcoin Lightning Network ⚡, the answer to how it is feasible to buy small things like a cup of coffee with Bitcoin.

A quick tip: There’s an explanation of words and abbreviations in the Fundamentals Glossary at the bottom.

📰 Essential News

KPMG Canada purchased Bitcoin: KPMG, one of the Big Four accounting organizations, which offers financial audit, tax, and advisory services has recently announced that they have purchased Bitcoin and Ethereum. They see that move as underpinning their outlook on emerging technologies underpinned by blockchain and are confident that they can now guide clients through the process of adding cryptocurrencies to their treasury. Positioning themselves to help other companies buy Bitcoin is a strong move by an accounting firm and sends a clear signal for Bitcoin acceptance and adoption.

Lightning available in Cash App: Cash App, a payment service from Block, has now generally enabled free and instant Bitcoin payments for their users. Cash App uses the Lightning Network behind the scenes for this functionality, so the feature isn’t exclusive to Cash App but ties into the generally available network to pay anywhere that accepts lightning. To pay with Bitcoin users scan a QR code using their phone, confirm the payment, and tap “Pay.”

$3.6 billion stolen Bitcoin recovered: 19,756 Bitcoin got stolen from the cryptocurrency exchange Bitfinex in 2016. Recently, they were discovered in the possession of two entrepreneurs by following the digital footprints of the transactions made with the stolen Bitcoin. The story is weird. Reportedly, the Bitcoin wallets and keys were stored on iCloud inside a file lacking serious encryption — a beginner mistake. What’s even more confusing is that one of the alleged hackers has a cringe-rapper alter ego named RAZZLEKHAN. I couldn’t make this up even if I tried.

🎯Focus: The Bitcoin Lightning Network

In a recent edition of The Bitcoin Espresso, we’ve seen that Bitcoin’s mining difficulty adjustment mechanism means that Bitcoin’s speed is independent of energy usage. But if more energy can’t speed Bitcoin transactions up, what can? Don’t you read everywhere that Bitcoin is slow and can’t scale to the number of transactions it would need to process to really replace current payment networks? This article is about the Lightning Network, a core innovation that often seems to be willfully ignored.

The Bitcoin Lightning Network⚡ is a network layer on top of Bitcoin. It’s a bit like an app that works on top of Bitcoin. It allows for essentially free and instant payments using Bitcoin. Lightning made it possible for El Salvador to make Bitcoin legal tender. It’s how its people buy day-to-day things like a cup of coffee with Bitcoin.

But what does layering mean in this context? You’re using a layered technology right now — the Internet. Its layers include one for basic network data transmission, a layer to connect to other network participants, a layer to reliably transmit data between participants, and a layer for applications like your browser (Chrome, Safari,…). These layers have dedicated purposes to fulfill different requirements, and they are used together. Likewise, the Lightning Network is a layer on top of Bitcoin to send free and near-instant micropayments to anywhere in the world 🌎.

While the Bitcoin network is optimized for stability, security, and payment size, Lightning optimizes for speed. So, how does it work? With Bitcoin, every transaction happens on a global, public ledger — the blockchain. But does the whole world really need to know quickly about every transaction? Even for cases such as buying a cup of coffee? What if two people making a transaction could agree that the payment has taken place in a secure, private, trustless, and permissionless way? The Lightning Network achieves this with channels, a relationship between two parties agreeing on how much money they have available.

It’s like having a tab at your favorite pub. 🍻

You can comfortably call for drinks and settle the payment later. The Lightning analog to these transactions would be off-chain (not on the blockchain) transactions. Paying your tab would be analogous to closing a channel, settling the state of your channel on Bitcoin’s blockchain, an on-chain (on the blockchain) transaction. This distinction allows Lightning to provide tremendous scalability advantages — Lightning’s off-chain transactions don’t have to wait 10 minutes on average for the Bitcoin network to create the next block with transactions.

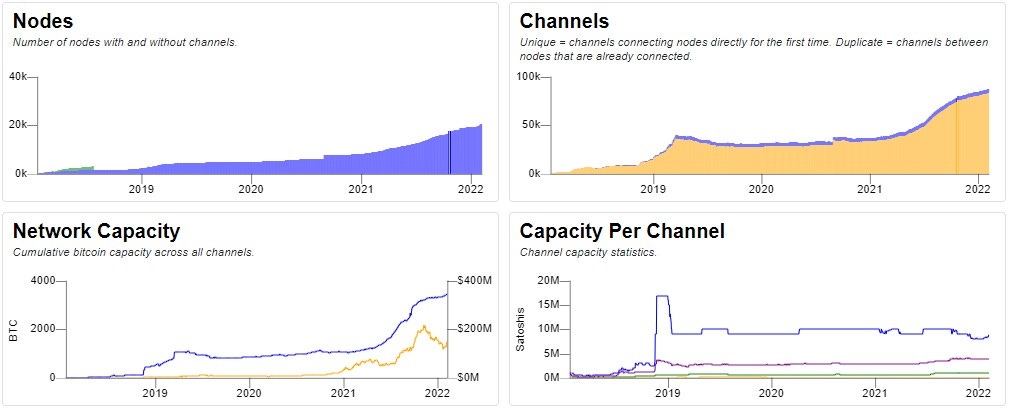

Even better, the payment channels can be used as a network to handle payments between people connected through other people. If Alice is connected through Bob to Charlie (Alice ⇄ Bob ⇄ Charlie), Alice can send money to Charlie through Bob’s channel. If enough channels between people are open, this mechanism allows for worldwide payments with Lightning. Passing transactions through channels requires them to have the necessary Bitcoin balance, which is why Lightning optimizes for micropayments, and the capacity of the channels is a closely watched metric. Both the number of channels and channel capacity have increased significantly over the last few years.

But what if someone tries to cheat with Lightning payments? Since the transactions are off-chain, they lack the fraud prevention mechanisms of Bitcoin. Lightning instead uses contracts that apply heavy penalties if fraud is detected. If someone attempts to cheat you, your lightning app will get back your own Bitcoin in addition to the cheater’s entire Bitcoin balance. How this works exactly is too much for an introductory article. If you want to dive deeper into the topic, Mastering the Lightning Network by Andreas M. Antonopoulos, Olaoluwa Osuntokun, and Rene Pickhardt is freely available on GitHub. Furthermore, the Lightning Network Paper from 2016 is a commonly suggested source.

Lastly, let me observe that Bitcoin critics seem to constantly forget that Bitcoin is software. They are stuck purely arguing about the status quo, but Bitcoin isn’t set in stone. It improves and is built upon with time. Lightning is software layered on Bitcoin that adds free, instant, worldwide payments. Can you imagine what else the future will bring with Bitcoin?

Did you like this edition’s article? Share it with someone who might like it, too!

And if you haven’t yet, sign up for The Bitcoin Espresso now!

Are you still looking for more to read? deepculture is a weekly smart digest that sends you 20 interesting things every Tuesday. There’s also great books and wisdom bites to discover.

💡 Fundamentals Glossary

Blockchain … the digital ledger that the Bitcoin network collectively manages as a shared database of transactions

Cryptocurrency … A digital currency that uses cryptography to prevent counterfeiting and fraudulent transactions. There are other cryptocurrencies besides Bitcoin.

Ledger … a bookkeeping concept; a collection of accounts with transactions of either debit or credit in separate columns having a closing balance

Lightning Channels … a relationship between two parties agreeing on how much Bitcoin they have available to be used for payment transactions.

Lightning Network … a layer on top of Bitcoin to send free and near-instant micropayments to anywhere in the world.

Do you want me to tackle a particular topic? Or do you want to tell me how The Bitcoin Espresso is doing? Give feedback or comment on this post to make this the best newsletter possible.

The Bitcoin Espresso does not constitute financial-, tax- or investment- advice, nor is it an offer or invitation to purchase any digital assets. You are solely responsible for your own investment decisions.

The Bitcoin Espresso is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness, or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance, or events that differ from those statements.