The Bitcoin Espresso ☕ #11 — Lightning, Paypal, JPMorgan & Reporting Tax with Accointing

Welcome to this week’s The Bitcoin Espresso! Whether you’re interested in Bitcoin, have just bought your first fractions of Bitcoin, or want to dive deeper into the space — this newsletter is for you. Find out more about the motivation behind this newsletter in the introduction post. Want more news? Follow @thebitcoinespresso on Twitter to stay on top of things between newsletters.

Weekly Summary: Bitcoin’s price continued its downtrend but recovered slightly recently. The concern for the Federal Reserve’s expected policy changes of rising interest rates and reducing asset purchases to counter high inflation is still holding the broader markets in its grasp, and Bitcoin along with it. Last week, Cash App rolled out lightning support, Paypal was reported to experiment with its own stablecoin, and JPMorgan published expectations for 2022. Today’s focus shows how to make your life easier by using software to help you with your Bitcoin tax reporting.

A quick tip: There’s an explanation of words and abbreviations in the Fundamentals Glossary at the bottom.

📰 Essential News

Cash App rolling out Lightning: The Lightning Network is a technology layered on Bitcoin that allows for essentially free and instant payments using Bitcoin. I consider Lightning, which plays a significant role in how El Salvador could make Bitcoin legal tender, a crucial part of Bitcoin’s future and will cover it in a future edition of The Bitcoin Espresso. Lightning is now supported by Cash App, a payment service from Block, to bring its advantages of essentially free and instant payments to Cash App users.

PayPal Experimenting with its Own Stablecoin: Recent news pointed out that regulations are likely to target stablecoins. Nevertheless, PayPal seems to be exploring to create its own stablecoin backed by the U.S. dollar that is purpose-built for payments. I’d reckon that most payment providers are nowadays running cryptocurrency experiments behind the scenes, and it’s only a matter of time until more of them will be ready for use.

JPMorgan analyst expectations for 2022: JPMorgan equity research analyst Kenneth Worthington anticipates 2022 to be the year of the “blockchain bridge (driving greater interoperability of various chains) or the year of financial tokenization.” On the topic of Bitcoin, they state that it is “particularly well-designed as a modern store of value, and the strong design has contributed to the increased confidence in and value of Bitcoin.” While cryptocurrency views from traditional bankers can be met with a fair share of reservations, it’s interesting to observe their expectations of how the space will develop.

🎯Focus: Cryptocurrency Tax with Accointing

Cryptocurrency taxes are handled differently all over the world. But I dare to suggest that most of us agree on the following statement no matter where we are: It’s no fun to create the documents to report our taxes properly.

[Disclaimer: I’m not a tax counselor. Consult tax experts before making financial decisions.]

A few years back, I used my software engineering skills to write a program that would calculate the taxes I would have to pay based on the transactions I exported from various wallets and exchanges. Even though it worked, I eventually decided that I wasted my time. Legislation on the topic is still in its infancy and is bound to change. The same goes for tax calculations, reports, and export formats for wallets or exchanges. The effort to maintain the functionality alone isn’t worth the effort. So, to save you from making my mistakes, I’ll introduce you to the service I use to make that part of my life more comfortable — Accointing.com

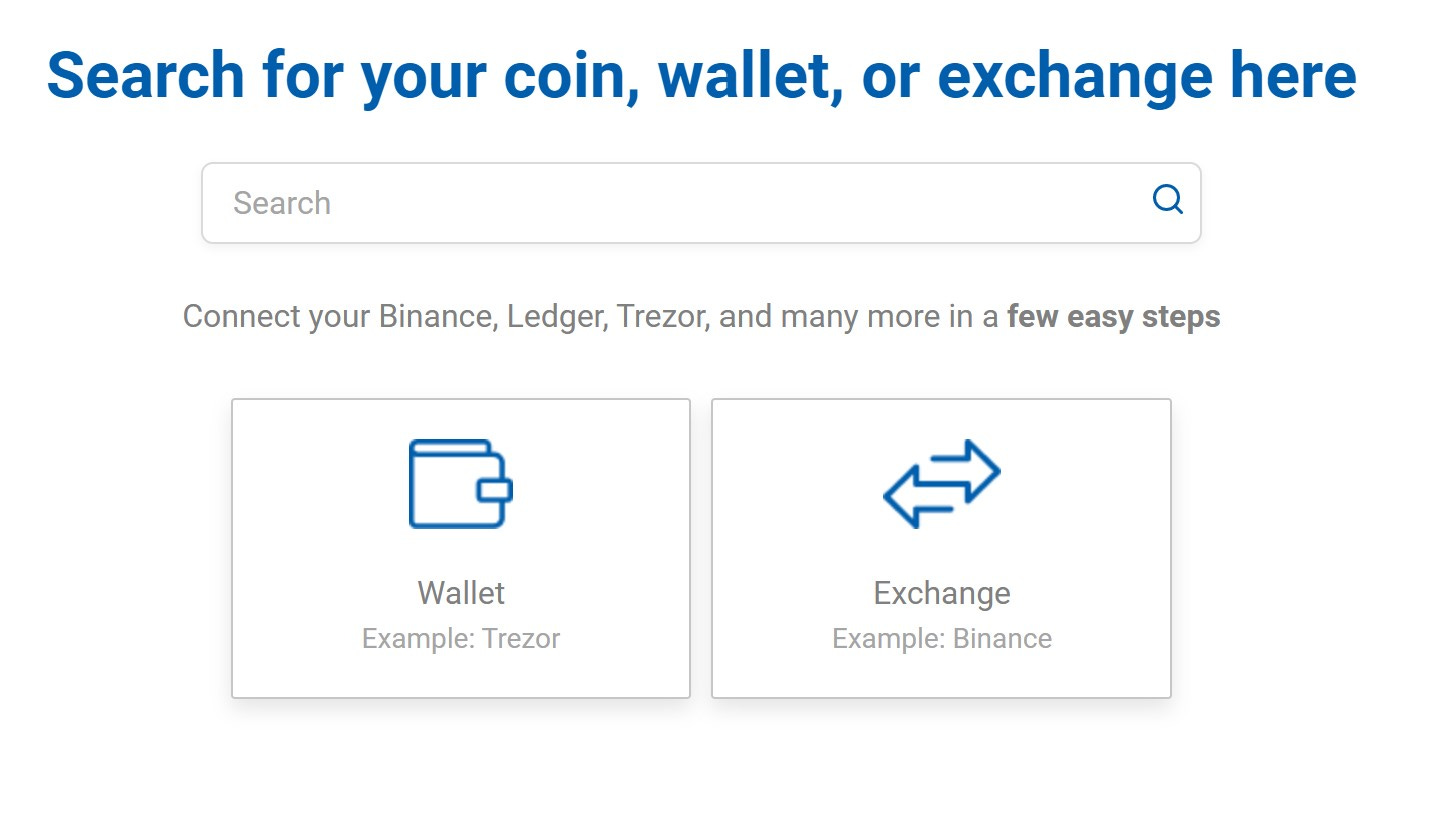

In its essence, it takes care of the obstacles I faced. First, it imports your cryptocurrency transactions from wallets and transactions. This is needed to match your buy- and sell actions and consider short- or long-term holding periods to calculate the incurred taxes.

Which transactions are taxable events and how they are taxed depends on the country you pay taxes in. This is why Accointing allows you to configure tax settings for your country and has helpful guides for cryptocurrency taxes for some countries (e.g. US crypto tax guide).

This should already be all you need to create your tax reports and save you, or your tax accountant, considerable time.

On top of that, Accointing has useful portfolio overview features and a visualization of your long-term and short-term gains. Accointing provides a case study with a real-life example that makes the tax concepts a bit more approachable.

Overall, Accointing offers precisely what you would expect from a service that helps you file your cryptocurrency taxes. If you have more than a handful of transactions that you can easily report, I can speak from experience in saying that going straight to Accointing is the way to go.

Did you recently discuss Bitcoin with someone who might like The Bitcoin Espresso?

And if you haven’t yet, sign up for The Bitcoin Espresso now!

Can’t get enough of reading newsletters? Check out The Sample 💌, which sends you newsletter recommendations based on your interest.

💡 Fundamentals Glossary

Blockchain … the digital ledger that the Bitcoin network collectively manages as a shared database of transactions

Cryptocurrency … A digital currency that uses cryptography to prevent counterfeiting and fraudulent transactions. There are other cryptocurrencies besides Bitcoin.

Stablecoin … A cryptocurrency that aims to maintain the value of a specific asset (often the U.S. dollar).

Do you want me to tackle a particular topic? Or do you want to tell me how The Bitcoin Espresso is doing? Give feedback or comment on this post to make this the best newsletter possible.

The Bitcoin Espresso does not constitute financial-, tax- or investment- advice, nor is it an offer or invitation to purchase any digital assets. You are solely responsible for your own investment decisions.

The Bitcoin Espresso is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness, or correctness of this article or opinions contained herein.

Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance, or events that differ from those statements.